child tax credit portal for non filers

Your remaining credit. Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students.

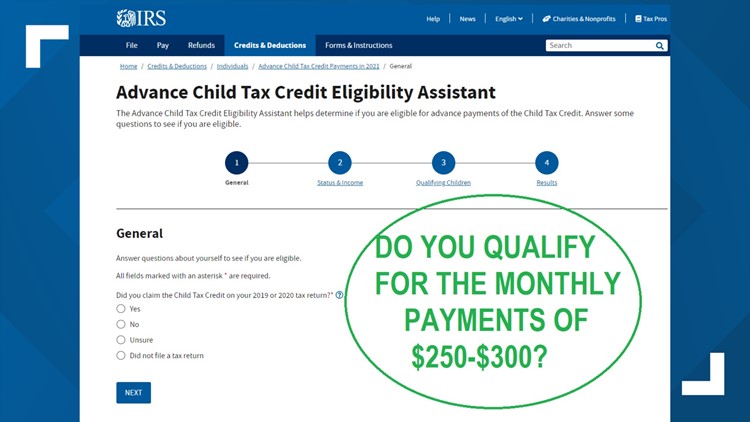

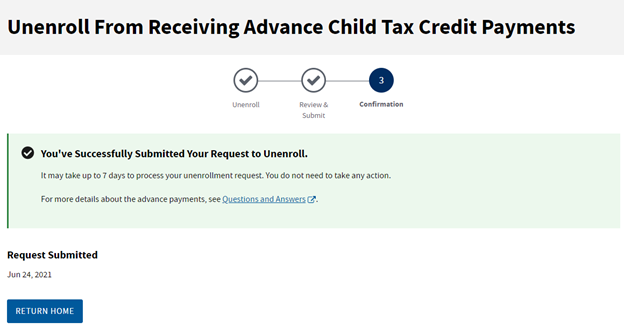

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

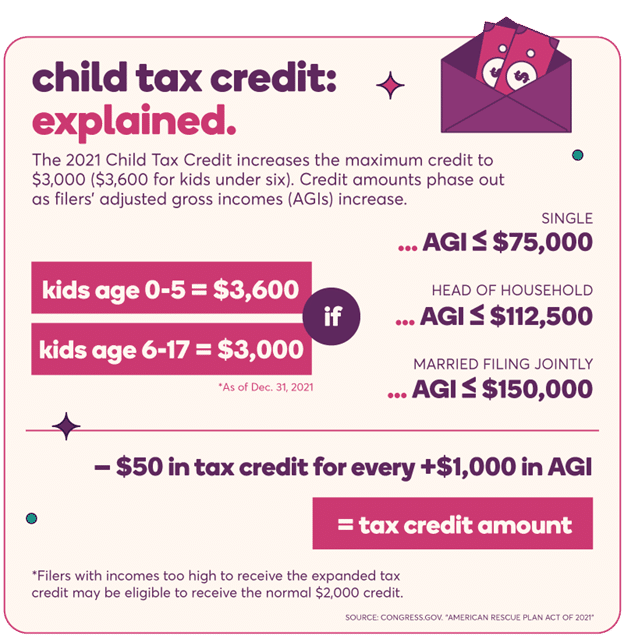

. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Non-filers Can Use GetCTC to Get Your Child Tax Credit. The Child Tax Credit Update Portal is no longer available.

Heres a link to the Code for America non-filer sign-up tool. For the current tax year though the Child Tax Credit is fully refundable and its also worth a lot more money. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Up to 3000 for children aged 6 to 17. Filing taxes is how you receive Child Tax Credit payments that you are owed for 2021. The Child Tax Credit will also be fully.

I talked for 40 minutes to Commissioner Rettig on. Have been a US. According to the tax agency the Child Tax Credit portal was built.

Up to 3000 for children aged 6 to 17. People who received advance CTC payments can also check the amount of their payments by using. Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students.

Key Democrats say they are pressing the IRS to overhaul the site to ensure its straightforward and easy for non-filers. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The White House has put a temporary pause on the IRS Child Tax Credit tool Politico reported on March 3.

The Child Tax Credit will also be fully refundable this. As a part of the Act the IRS will pay eligible taxpayers half of their estimated 2021 Child Tax Credit in advance monthly payments beginning in July 2021. The newly and temporarily expanded Child Tax Credit provides eligible parents with a 3000 credit for every child ages 6 through 17 and 3600 for every child under age 6.

Families including those who received part of their Child Tax Credit as monthly payments last year can get their remaining Child Tax Credit by filing a. The credit is increasing to 3600 for children under the age of 6. Who should use the.

If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the.

Child Tax Credit U S Representative Jimmy Gomez

Child Tax Credit Payments Begin Arriving Today For Almost One Million Kids In State Abc 36 News

Training How To Become A Ctc Navigator And Non Filer Portal Walk Through Youtube

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Irs Launches Tool For Nonfilers To Receive Stimulus Payments Journal Of Accountancy

Advance Child Tax Credit Payments Start This Month Wessel Company

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Fearing Filing Season Chaos Irs Hits Pause On Web Tool For Child Tax Credit Politico

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Child Tax Credit What We Do Community Advocates

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com

Jfi Assessing Non Filer Rates Poverty Impacts For The American Rescue Plan Act S Expanded Ctc

![]()

Child Tax Credit Update Irs Launches Two Online Portals

Child Tax Credit Health And Human Services Montgomery County

Child Tax Credit Update Irs Launches Two Online Portals

Non Tax Filers Can Now Sign Up For The Monthly Child Tax Credit

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue